PF Wage Ceilings: What the 2025–2026 Changes Mean for Employees and Employers

The CPF wage ceiling 2025 has officially increased to S$7,400, marking a significant shift in Singapore’s retirement savings landscape. This adjustment affects both working adults and employers, requiring immediate attention to payroll calculations and contribution strategies. Understanding these changes is crucial for compliance and financial planning as we progress toward the final ceiling of S$8,000 in 2026.

Understanding CPF Wage Ceilings

What Are CPF Wage Ceilings?

CPF wage ceilings establish the maximum monthly and annual wage amounts subject to Central Provident Fund contributions. These limits ensure that CPF contributions remain proportionate to earnings while providing adequate retirement savings for middle-income Singaporeans.

The CPF wage ceiling system operates on two primary components:

Ordinary Wage (OW) Ceiling: This limits the amount of monthly ordinary wages that attract CPF contributions. For 2025, this ceiling stands at S$7,400 per month.

Annual Salary Ceiling: This remains unchanged at S$102,000, encompassing both ordinary wages and additional wages throughout the calendar year.

Breaking Down the Ordinary Wage Ceiling

What Constitutes Ordinary Wages?

Ordinary wages refer to wages due or granted wholly and exclusively for an employee’s work in a specific month. These include:

- Basic salary

- Food allowances

- Overtime payments earned and paid within the month

- Shift allowances

- Commission payments (if paid monthly)

For wages to qualify as ordinary wages, they must meet two critical conditions:

- Monthly exclusivity: The wages must be granted specifically for that calendar month.

- Timely payment: Wages must be paid before the 14th of the following month.

It is worth noting that classifying allowances correctly (e.g., monthly vs ad-hoc commission) prevents miscalculations that can ripple through your AW ceiling at year-end.

Current Ordinary Wage Ceiling Rates

The ordinary wage ceiling has undergone systematic increases to keep pace with rising salaries and strengthen retirement adequacy. Here’s how the progression works:

| Period | OW Ceiling | Increase | Annual Ceiling |

|---|---|---|---|

| 1 Jan 2016 – 31 Aug 2023 | S$6,000 | – | S$102,000 |

| 1 Sep 2023 – 31 Dec 2023 | S$6,300 | +S$300 | S$102,000 |

| 1 Jan 2024 – 31 Dec 2024 | S$6,800 | +S$500 | S$102,000 |

| 1 Jan 2025 – 31 Dec 2025 | S$7,400 | +S$600 | S$102,000 |

| 1 Jan 2026 onwards | S$8,000 | +S$600 | S$102,000 |

Understanding the Additional Wage Ceiling

What Are Additional Wages?

Additional wages encompass wage supplements not granted wholly and exclusively for a specific month. Common examples include:

- Annual bonuses (including 13th month bonus/AWS)

- Performance bonuses

- Leave pay

- Long service awards

- Director’s fees

- Commission payments (if not paid monthly)

How the Additional Wage Ceiling Works

The additional wage ceiling operates on a per-employer, per-year basis using this formula:

AW Ceiling = S$102,000 − Total Ordinary Wages subject to CPF for the year

This dynamic calculation helps ensure that employees earning the same annual salary receive broadly equivalent CPF contributions regardless of how their pay is structured. For the formal definition and rules, see the CPF’s official guidance on the Additional Wage (AW) ceiling.

Practical Example: Additional Wage Ceiling Calculation

Consider Sarah, a marketing manager earning S$8,000 monthly in 2025:

Step 1: Calculate OW subject to CPF

- Monthly OW ceiling: S$7,400

- Annual OW subject to CPF: S$7,400 × 12 = S$88,800

Step 2: Calculate AW ceiling

- AW ceiling: S$102,000 − S$88,800 = S$13,200

Result: Sarah’s annual bonus is subject to CPF contributions up to S$13,200. Any bonus amount exceeding this ceiling will not attract CPF contributions.

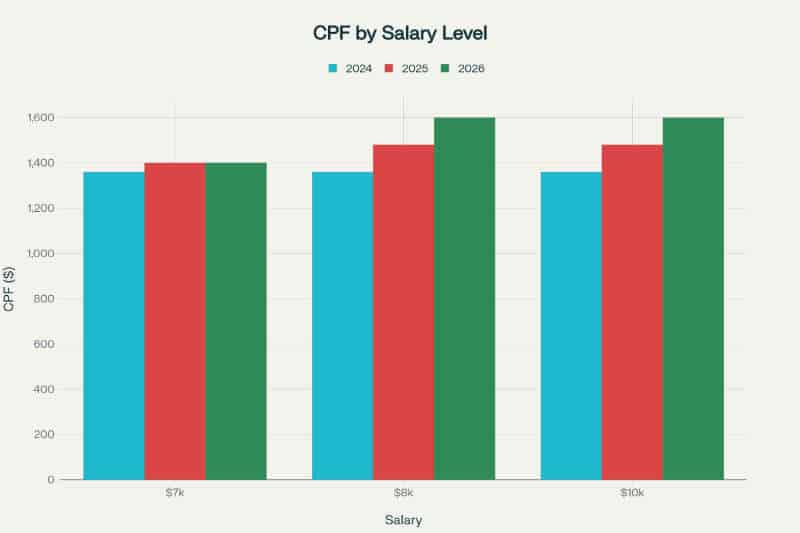

Employee CPF contributions by salary level showing impact of wage ceiling increases from 2024–2026

Impact on Working Adults

Changes in Take-Home Pay

The CPF wage ceiling increases directly affect employees’ monthly take-home pay. The chart above illustrates how different salary levels experience varying impacts from the ceiling adjustments (as at 1 January 2025).

For employees earning S$7,000 monthly:

- 2024: Employee contribution = S$1,360 (capped at S$6,800 × 20%)

- 2025: Employee contribution = S$1,400 (actual salary × 20%, below new cap)

- Monthly reduction: S$40

For employees earning S$8,000 monthly:

- 2024: Employee contribution = S$1,360 (capped at S$6,800 × 20%)

- 2025: Employee contribution = S$1,480 (capped at S$7,400 × 20%)

- 2026: Employee contribution = S$1,600 (full salary × 20%)

- Monthly reduction by 2026: S$240

For employees earning S$10,000 monthly:

- Same progression as S$8,000 earners

- Maximum monthly reduction: S$240 (reached in 2026)

Long-term Benefits

While immediate take-home pay decreases, the increased contributions significantly boost retirement savings. For example, an employee earning S$8,000 monthly could see combined employer-and-employee CPF contributions increase by about S$444 per month (vs 2024), adding ~S$133,000 over 25 years before interest. One implication is that the compounding effect of higher balances and additional interest can materially improve retirement adequacy.

Implications for Employers

Payroll Calculation Updates

Employers must adjust their payroll systems to accommodate the new wage ceilings. Key considerations include:

Monthly Contributions: Employers contribute 17% of ordinary wages (for employees aged 55 and below) up to the S$7,400 ceiling.

Additional Wage Calculations: Employers must recalculate AW ceilings whenever:

- Employee salaries change during the year

- Employees join or leave the company

- Year-end bonus payments are made

Compliance Requirements

Employers face several compliance obligations:

Timely Payments: CPF contributions must be paid by the 14th of the following month.

Accurate Wage Classification: Proper distinction between ordinary and additional wages is crucial for correct contribution calculations.

Record Keeping: Maintain detailed records of wage payments and contribution calculations for audit purposes.

A possible drawback is that year-end reconciliations can be error-prone—particularly with mid-year joiners, promotions, or multiple variable-pay events—so proactive AW ceiling tracking reduces costly corrections.

Example: Multi-Scenario Employer Calculations

TechStart Pte Ltd employs three staff members with different circumstances:

Employee A – John (Age 30)

- Monthly salary: S$9,000

- 2025 OW subject to CPF: S$7,400

- Employer contribution: S$7,400 × 17% = S$1,258

- Employee contribution: S$7,400 × 20% = S$1,480

Employee B – Lisa (Age 28, joined mid-year)

- Monthly salary: S$6,000 (started July 2025)

- AW ceiling for 2025: S$102,000 − (S$6,000 × 6 months) = S$66,000

- Year-end bonus: S$20,000 (fully subject to CPF)

- Employer contribution on bonus: S$20,000 × 17% = S$3,400

Employee C – David (Age 58)

- Monthly salary: S$8,500

- Applicable rates: Employer 15.5%, Employee 17%

- OW subject to CPF: S$7,400

- Employer contribution: S$7,400 × 15.5% = S$1,147

- Employee contribution: S$7,400 × 17% = S$1,258

Calculating CPF Contributions: Step-by-Step Guide

For Ordinary Wages

Step 1: Determine the employee’s total monthly wages

Step 2: Apply the OW ceiling (S$7,400 for 2025)

Step 3: Calculate contributions using age-appropriate rates

Step 4: Round employer contributions up to the nearest dollar; drop cents for employee contributions

For Additional Wages

Step 1: Calculate the AW ceiling using the formula: S$102,000 − Total OW subject to CPF for the year

Step 2: Determine AW amount subject to CPF (not exceeding the ceiling)

Step 3: Apply contribution rates based on the employee’s age and citizenship status

Step 4: Recalculate at year-end or upon employment termination

Complex Scenario Example

MegaCorp Pte Ltd has an employee, Michael, with changing circumstances:

January–June 2025: Salary S$7,000/month

- Monthly CPF on OW: (S$7,000 × 37%) = S$2,590

- Total OW subject to CPF (6 months): S$42,000

July–December 2025: Promoted, salary S$9,000/month

- Monthly CPF on OW: (S$7,400 × 37%) = S$2,738

- Additional OW subject to CPF (6 months): S$44,400

Year-end AW ceiling calculation:

- Total OW subject to CPF: S$42,000 + S$44,400 = S$86,400

- AW ceiling: S$102,000 − S$86,400 = S$15,600

December bonus: S$25,000

- AW subject to CPF: S$15,600 (capped)

- CPF on AW: S$15,600 × 37% = S$5,772

Some employees may find that large one-off bonuses exceed their AW ceiling, leaving part of the bonus without CPF contributions—useful for cash flow, but it also means lower savings growth from CPF interest.

Recent Changes and Future Outlook

2025 Key Updates

Several important changes took effect on 1 January 2025:

Ordinary Wage Ceiling Increase: From S$6,800 to S$7,400 monthly. For a summary of the changes and their intent, see CPF changes in 2025.

Senior Worker Contribution Increases: CPF rates for workers aged 55–65 increased by 1.5% total (0.5% employer, 1% employee).

One-Year CPF Transition Offset: The Government provides an offset equivalent to half the 2025 increase to cushion business impact.

Planning for 2026

The final increase to S$8,000 monthly ceiling in 2026 will complete the four-year adjustment cycle. Employers should prepare for:

- Further payroll system updates

- Additional contribution increases for higher earners

- Continued AW ceiling recalculations

Best Practices for Compliance

For Employers

System Updates: Ensure payroll systems reflect current wage ceilings and contribution rates.

Staff Training: Train HR and payroll staff on proper wage classification and calculation methods.

Regular Reviews: Conduct periodic reviews of employee wage structures and contribution calculations.

Documentation: Maintain comprehensive records of all wage payments and CPF calculations.

For Employees

Monitor Contributions: Regularly check CPF statements to ensure accurate contributions.

Understand Classifications: Know how your wages are classified (ordinary vs additional) and why.

Plan for Changes: Adjust personal budgets to account for increased CPF contributions.

Maximise Benefits: Consider voluntary top-ups to enhance retirement savings where appropriate.

Conclusion and Action Steps

The CPF wage ceiling 2025 increase to S$7,400 represents a crucial step in strengthening Singapore’s retirement savings framework. While this change reduces immediate take-home pay for middle and higher-income earners, it significantly enhances long-term financial security through increased CPF accumulation.

Key Takeaways:

- The ordinary wage ceiling increased to S$7,400 in 2025, with a final increase to S$8,000 planned for 2026.

- Additional wage ceilings are calculated dynamically based on annual ordinary wage contributions.

- Employees earning above the ceiling will see reduced take-home pay but enhanced retirement savings.

- Employers must update payroll systems and ensure proper wage classification for compliance.

Immediate Action Items:

For Employers

- Update payroll systems to reflect the new S$7,400 ceiling.

- Review and recalculate all additional wage ceiling computations for 2025.

- Train payroll staff on proper implementation of the new rates.

- Prepare for 2026 changes by budgeting for the final ceiling increase.

For Employees

- Review your payslips to ensure correct CPF contributions under the new ceiling.

- Adjust personal budgets to account for reduced take-home pay if earning above S$7,400.

- Consider the long-term benefits of increased CPF savings for retirement planning.

- Clarify with HR if you notice discrepancies in CPF calculations.

This article is for general information only and does not constitute financial advice.